Fire ban in effect for Winnipeg: Outdoor fires are prohibited, including fire pits, open fires, and the use of fireworks.

Property Tax Bills

What’s new in 2025?

- Municipal Property Tax Increase

- School Tax Increases

- Changes in Provincial Tax Credits

- Manitoba School Tax Rebate

- Education Property Tax Credit

- Manitoba Homeowners Affordability Tax Credit

- 2025 General Assessment

Municipal Property Tax Increase

City Council has approved a 5.95% increase in the 2025 Property Taxes. The income generated by this will be dedicated as follows:

- 2.00% property tax increase dedicated to the renewal of local and regional streets, lanes, sidewalks and bridges as well as road safety improvement program, pedestrian and cycling programs and tree replacement and preservation on road renewal projects;

- 1.50% property tax increase dedicated to the tax-supported operating budget, which includes 0.33% previously dedicated to Transit Infrastructure Reserve (that will now fund Transit operations);

- 2.45% increase dedicated to a number of City initiatives

School Tax Increases

The eight (8) school divisions within the City of Winnipeg limits have increased their 2025 budget requirements to be raised through property taxes between 10.4% and 18.4%.

| School Division | 2024 Requirement | 2025 Requirement | Dollar Increase | Percent Increase |

|---|---|---|---|---|

Winnipeg |

$204,332,629 |

$232,243,465 |

$27,920,836 |

13.7% |

St. James-Assiniboia |

$62,529,157 |

$69,022,124 |

$6,492,967 |

10.4% |

Pembina Trails |

$116,073,240 |

$135,327,565 |

$19,254,325 |

16.6% |

Seven Oaks |

$58,701,794 |

$68,538,541 |

$9,836,747 |

16.8% |

Seine River |

$4,937,599 |

$5,646,540 |

$708,941 |

14.4% |

Interlake |

$41,064 |

$48,417 |

$7,353 |

17.9% |

Louis Riel |

$122,642,678 |

$145,168,804 |

$22,526,126 |

18.4% |

River East Transcona |

$89,053,869 |

$101,912,889 |

$12,859,020 |

14.4% |

Changes in Provincial Tax Credits

- In 2025, the Province of Manitoba eliminated the Manitoba School Tax Rebate on all properties, with the exception of farm properties. Farm properties will continue to receive a rebate equal to 50% of the gross school taxes.

- In 2025, the Province of Manitoba eliminated the Education Property Tax Credit (EPTC) Advance.

- In 2025, the Province of Manitoba created the Manitoba Homeowners Affordability Tax Credit (HATC).

Manitoba Homeowners Affordability Tax Credit

- The Homeowners Affordability Tax Credit (HATC), commencing in 2025, is a Provincial Tax Credit for homeowners provided to offset school taxes for homeowners - payable in Manitoba.

- The Homeowners Affordability Tax Credit Advance is where the HATC is applied directly to the municipal property tax statement for homeowners.

- Eligible property owners may receive a credit up to a maximum of $1,500

Eligibility criteria:

- The taxpayer must own the property and be their principal residence

- The property must be assessed as a single residential dwelling

- The homeowner cannot be receiving the credit on another home elsewhere in the Province

General Assessment Information

2025 Projected Assessment Roll

The 2025 Property Assessments have been updated to reflect typical market rental values as of April 1, 2023 in accordance with provincial legislation.

Taxable portioned assessment increased:

- 9.50% attributable to change in reference year (April 1, 2021 to April 1, 2023)

Important to Remember

- Municipal taxes make up only a portion of the total property taxes collected by the City.

- Overall, municipal taxes represent 47% of taxes collected while education taxes represent 53% of taxes collected.

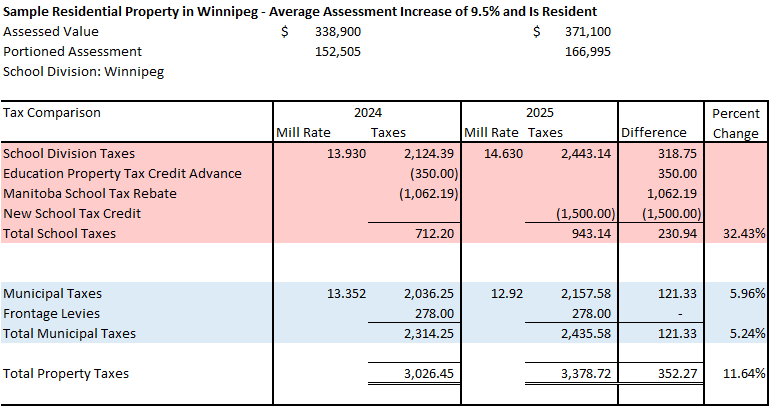

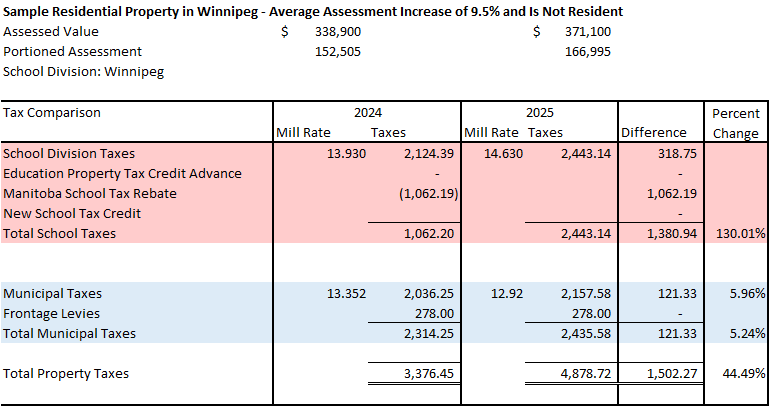

The bottom of this page contains comparative tax calculations for 2025 compared to 2024 for a sample home which take into account the general assessment increase, increases in mill rates, and changes to provincial tax credits.

Mill Rates

- The Municipal Mill Rate is 12.920. This rate decreased by 3.2% from 2024 to offset the effects of the general assessment and to incorporate property tax increase in 2025.

- The Provincial Education Support Levy mill rate for 2025 is 7.407, which is a decrease of 10% from 2024.

- The 2025 school divisions mill rates have changed from 2024.

Why did my municipal taxes increase more than 5.95%?

The amount of increase on the 2025 property tax bill (municipal component only) will be dependent on two elements:

- The increase in the assessed value of the property, and;

- The overall 5.95% property tax increase. Depending on individual circumstances, some properties may experience an increase more or less than 5.95%.

Generally speaking, if the assessment increase (2025 over 2024) is greater than 9.50%, the 2025 property tax increase will be more than 5.95%.

Conversely, if the assessment increase (2025 over 2024) is less than 9.50%, the 2025 property tax increase will be less than 5.95%.

Impact of Reassessment on Municipal Taxes

| If the Market Value of your home increased within these ranges | Your Municipal Property Taxes are projected to change wihtin these ranges |

|---|---|

| 0% - 3.32% | -3.24% to -.01% (municipal tax decrease) |

| 3.34% | No Change in municipal taxes |

| 3.35%-5% | 0.1% to 1.60% (municipal tax increase) |

| 5%-9.49% | 1.60% to 5.94% (municipal tax increase) |

| 9.50% | 5.95% (municipal tax increase) |

| 9.50% - 10% | 5.95% to 6.44% (municipal tax increase) |

| 10% - 15% | 6.44% to 11.25% (municipal tax increase) |

Learn more about assessed values and your property taxes.

Other reasons for tax increases

- Changes in education taxes - School division budget requirements have increased between 10.4% to 18.4%.

- In some cases, an increase in overall property taxes can be attributed to distribution. Distribution is the way property is valued as compared to the total assessment.

Payment Options

Learn more about payment options.

Sample Tax Bill Comparison 2025 to 2024

Property owner’s principal residence

Not property owner’s principal residence

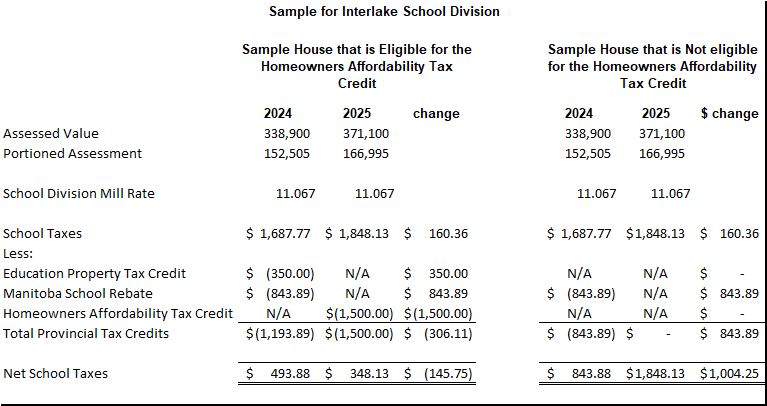

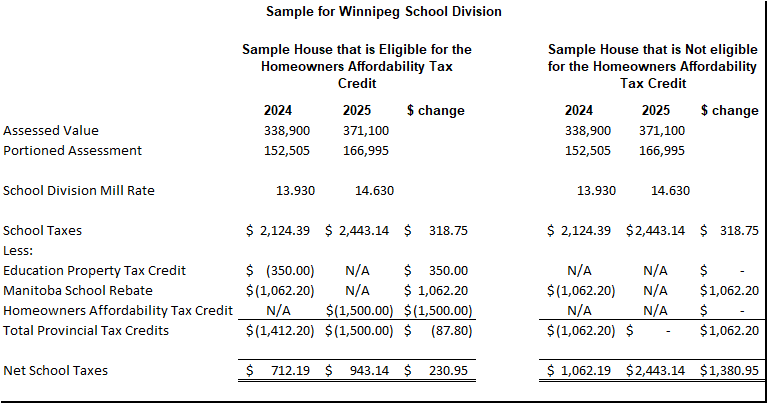

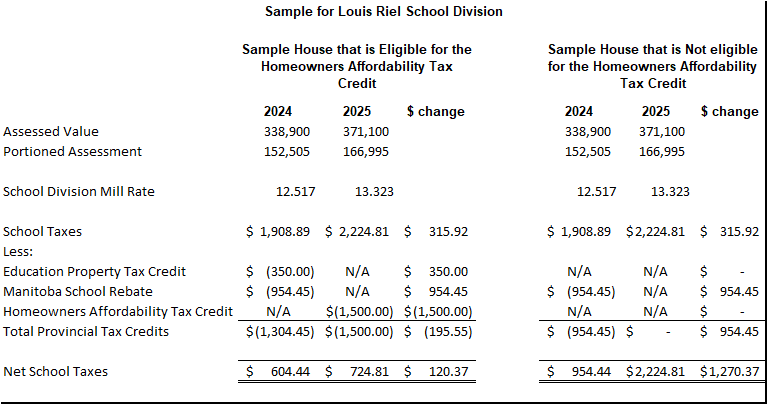

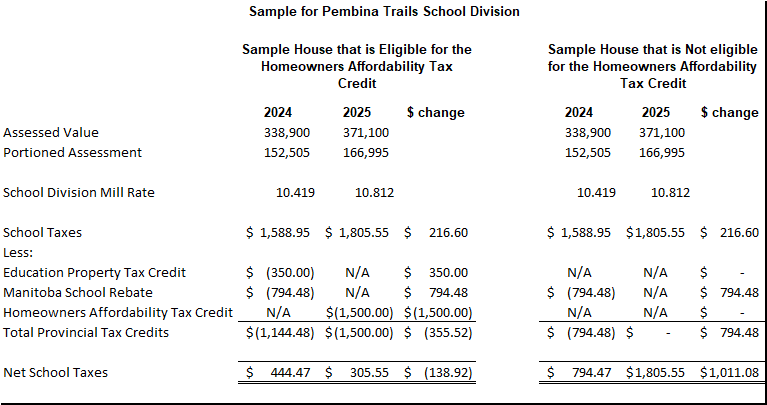

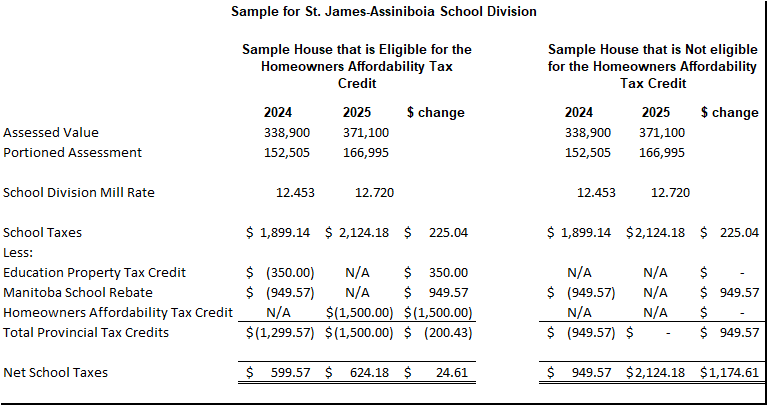

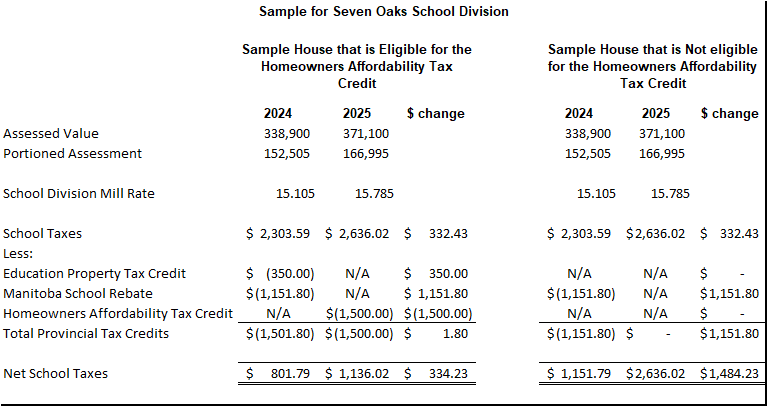

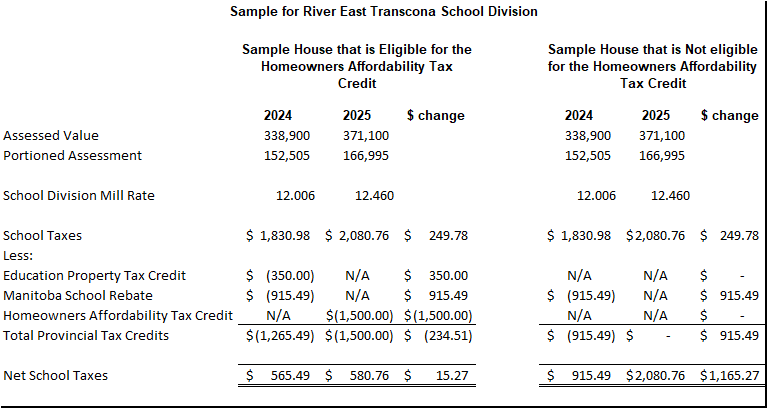

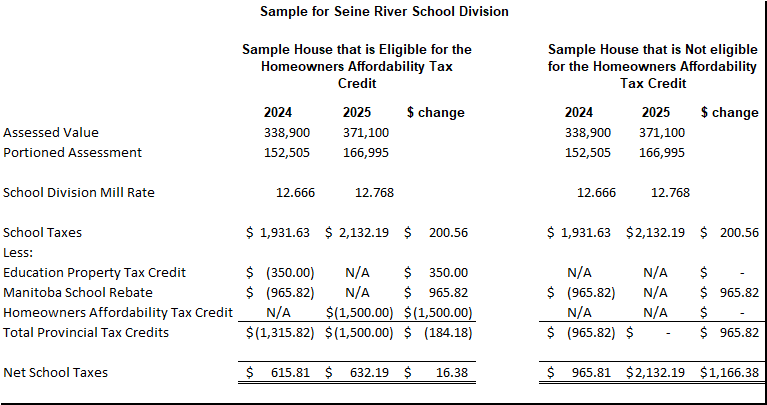

Sample Comparative School Tax by School Division

Winnipeg School Division

Louis Riel School Division

Pembina Trails School Division

St. James-Assiniboia School Division

Seven Oaks School Division

River East Transcona School Division

Seine River School Division

Interlake School Division