Tax Credit Programs

Manitoba Homeowners Affordability Tax Credit (HATC)

The Homeowners Affordability Tax Credit (HATC), commencing in 2025, is a Provincial Tax Credit for homeowners provided to offset school taxes for homeowners - payable in Manitoba.

The Homeowners Affordability Tax Credit Advance is where the HATC is applied directly to the municipal property tax statement for homeowners.

Calculation

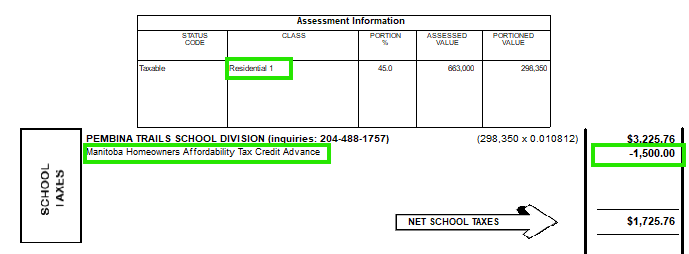

The lesser of the property owner’s school taxes for the taxation year and $1500 for tax year 2025, increasing to $1600 for 2026.

HATC Advance and HATC Self-Declaration

The Homeowners Affordability Tax Credit Advance can only be claimed on a homeowner’s principal residence, and only one person can claim the residence per taxation year. In order to qualify for the HATC Advance on your taxes:

- The taxpayer must own the property and be their principal residence

- The property must be assessed as a single residential dwelling

- The homeowner cannot be receiving the credit on another home elsewhere in the Province

- Ownership has not changed after the current year’s Tax Notice was issued

ILLUSTRATIVE SCHOOL TAX PORTION OF A 2025 RESIDENTIAL PROPERTY TAX STATEMENT

2025 Transitional Process

The Province had approved an adjustment period for 2025 tax year up until November 15, 2025. The intake for 2025 adjustments is now closed. Application forms received after November 15th, will be applicable for the 2026 tax year. Applications received before November 15th, 2025 will continue to be processed.

Any eligible homeowners that do not receive an adjustment during the adjustment period can claim the tax credit for the current year on their income tax return.

Application Process

In order to apply to have the credit added to your next year’s property tax bill you will need to fill out a Self-Declaration form online or in writing and return the completed form to the Assessment and Taxation Department by March 15.

Homeowners who have previously provided a self-declaration and have received the HATC credit in 2025 do not need to apply again for future years unless the title of their property changes or they no longer live in their home.

To advise the Assessment and Taxation Department that you should not receive the HATC, please complete the Self-Declaration form, indicating this in the “Declaration” section of the form.

Step 1: Confirm the property type is Residential.

Step 2: Download, and complete the Self-Declaration form

Step 3: Upload the completed form

Or submit to the Assessment and Taxation Department via one of the alternate methods below.

Self-Declaration forms can be remitted in writing:

Assessment and Taxation Department

510 Main St.

Winnipeg, MB R3B 3M2

In-person drop off

311 Counter

Main Floor, 510 Main St.

(Susan A. Thompson Building)

170 Goulet St.

Fax

204-986-6732

School Tax Rebate – Farm Properties

Property owners of farm properties in Manitoba will receive a 50% rebate of the school taxes directly on their annual property tax bill.

Farmland School Tax Rebate

If you own farmland in Manitoba, you may be eligible for a rebate on the farmland portion of your school taxes. This tax rebate program is offered/funded by the Province of Manitoba. This is a link to the Provincial Tax Assistance Office and provides additional information concerning the Farmland School Tax Rebate.

Other Incentive Programs

The Planning, Property and Development Department offers a range of financial assistance and incentive programs for the development/renovation of heritage buildings. The following provides a link to information concerning these various programs: incentive programs