|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

|

|

||||||||||||||

|

|

||||||||||||||

|

|||||||||||||||

|

|||||||||||||||

1 Statement Date

Mailing date of the statement

2 Roll Number

Property Identification Number

3 Property Address Information

This includes the address of the property as well as the registered owner(s) name

4 Title No

Certificate of title number register at Winnipeg Land Titles Office

5 Mortgage No

Mortgage Company name and reference number (if applicable)

6 Part of lot: Lot/Block/Plan/Parish

This is the legal description of the property

7 Status Code

Informs of the liability type of the property. Examples Taxable, Grant, Exempt

8 Class

Type of Property. Examples: Residential, Farm Use Value, Designated Recreational Property, Other

9 Portion %

This determines what percentage of the assessed value you are taxed at.

10 Assessed Value

The value of the property

11 Portioned Assessment

This is your taxable assessment. It is determined by multiplying the portion % by the assessed value

12 School Taxes

This is the calculation of school taxes. School Taxes = Portioned Assessment x School Division Mill Rate / 1,000

13 Manitoba Education Property Tax Credit (EPTC) Advance

This is a credit from the Provincial government. The residential property must be owner occupied as at January 1 of the current year in order to receive this credit.

14 Net School Taxes

Net School taxes are the sum of the school taxes and the Manitoba Education Property Tax Credit. The City remits this money to the individual school divisions.

15 City of Winnipeg Municipal Taxes

This is the calculation of municipal taxes. Municipal Taxes = Portioned Assessment x Municipal Mill Rate / 1,000

16 Street Renewal Levy

These are frontage levies for the maintenance and repair of existing infrastructure.

17 Local Improvement Levy

The Local Improvement is only charged to properties that are located within an area that has requested the City to do work.

18 Total Municipal Taxes

This is the total taxes charged by the City. This is the sum of the Municipal Taxes and other charges

19 Net Property Taxes

This is the sum of the Total Municipal Tax and the Net School Taxes

20 Arrears or Credits

Arrears balance is an amount outstanding at the time of billing. This can include but not limited to unpaid taxes, penalties, unpaid water bills, NSF fees etc.

Credits may also appear here on your bill and will appears as a negative amount. This could be related to your TIPP payments, prepayment of your taxes etc.

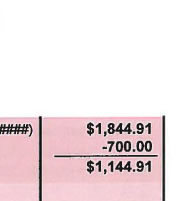

21 Balance Owing

This is the amount outstanding at the time of bill production in April. If there are arrears on your account, your outstanding balance for the end of June will be different than as shown on the bill.

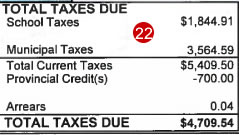

22 Total Taxes Due

This is a summary of all the bill calculations for easy reference.

23 Important Messages

Messages to property owners are listed in this section. It is very important to read this section for your bill.

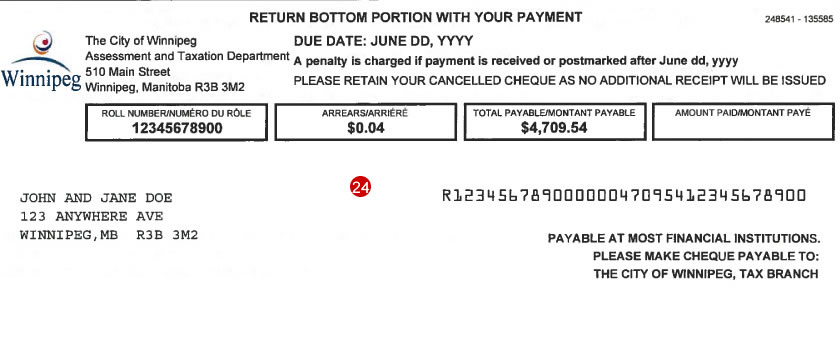

24 Remittance Stub

This is the portion of the bill that is returned with your payment. Please note that if you are a TIPP or mortgage customer the balance owing will be paid by either automatic withdrawal or by your mortgage company.